To kick off I picked up on this bond discussion from one of the global wealth forums. Thought I'd post here for consideration.

Question: Is a secular bear market in bonds about to start? We are witnessing many fundamental and technical factors to suggest this including but not limited to an unsustainable expansion in the US monetary base and unprecedented amount of buying in the US Treasury and Corporate bond markets as stock market participants flee in droves. Technically, the 30-year US Treasury bond yield chart has put in a breakdown failure on the yearly chart after a consolidation in yields from 2002-2007. A move north of the yield highs of 2008-09 in 2010 would turn the trend up and start the secular bear. (see http://research.stlouisfed.org/fred2/graph/?s[1][id]=AMBNS )Now there's a question - lots of talk about the fair value of bonds. I'm always cynical of technical indicators unless the 'herd' believes them (or I make them up myself).. but always open to chart patterns that emerge.

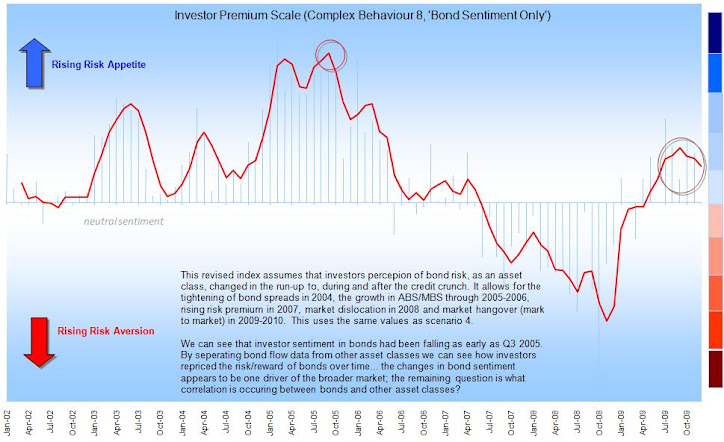

Where will yields go? - hard to say - prices will fall so most yields on existing issues will head north but what of new placings - the capital squeeze looks less severe, the need to raise capital less - I don't see (much) need for companies to give up high yields unless they need to restructure their debt; (we may see shifts in the SWAPS market for example). Sovereigns on the other hand have large deficits and every need to rob Peter to pay Paul. Investor sentiment will stabilise and we'll likely return to sth like a 2004 bond market. Tight but so-so efficient and relatively stable.. that would support a new equity market if we follow the events of 2003-2006.

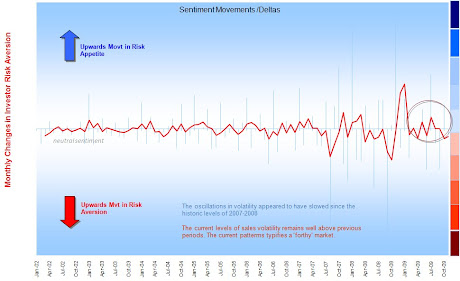

In terms of buying patterns then, globally, the 'money' has already begun to rotate out of bonds - it is pricing for a decline. What's confusing the market is that institutions have had lots of capital in reserve since 2008 and are now investing it; (this is one of the few occassions where the average investor has little power over short term market direction). Be aware - any large influx of money will facilitate the greatest change in secondary market prices in bond markets.. bond traders will continue to do what they do.. I suspect behind the institutional injection; investors are moving away from bonds.

Just be ready to move to capitalise/defend your portfolios.

JB

A good response from Ben **see below**

ReplyDeleteLots in there to mull over, ponder and puzzle but bottom line Ben makes is clear - expect a bear market or at least higher risk to future interest rates..

I'll track back current flows into/out of bond funds asap.. (only part of the market admittedly but the most transparent for our purposes).

"JB,

Thanks for your comments. Just to clarify . . I don’t like using indicators such as MACD, Bollinger bands, and stochastics. I do know how to use them, but these are derived from price; and the user defined inputs for these indicators are subjective. For example, which moving average do you use (20, 30, 40, 50)? I focus on reading the price bars (candlesticks) and interpreting the “language” they speak. Market participants express their expectations on the price chart and reading that is what is key to understanding possible human behavior in the future. So, if an investor panicked in late 2008 and bought bonds, today they are underwater. What if you shorted (treasury zero coupon) bonds then? You would be in “hog heaven.”

As for where rates will go . . that is hard to say, but above the 2009 yield levels starts an uptrend in the long term secular chart. Markets move to put the maximum number of participants on the wrong side of the trade before the real move begins . . . and a record number of corporates ($4.9 Trill) and Treasuries were purchased in 08-09 . . . most of those buyers are now underwater. Those buyers will be the “fuel” to start the bear market if rates get above the 2007-09 highs (again, the herd will panic in bonds/currency sometime later).

Please check out my box.net files showing 30 Yr US Tsy Yields 1977-2009. This is a classic breakdown failure (‘08-09) after a consolidation (2003-07). This is truly a classic pattern that I have seen over and over again. If rates go north of 2009 highs and hold, an uptrend will start in earnest. Watch for where rate levels close in 2010.

Over-stimulus is a huge concern for me as well. But remember, governments can do 3 things with their deficits/debt . . . . pay it off (not likely), default on it (a disaster), or print money to reduce the real value of it in future (to allow more borrowing then). The last one is most likely given the current market and political structure."