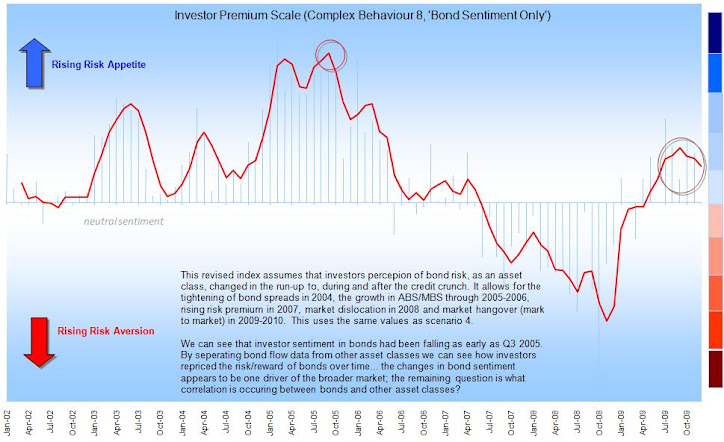

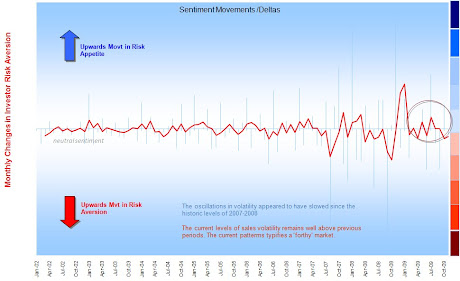

As a fund-analyst and product manager between 2001-2008 I was struck by the absence of market risk discussions from 2006 into 07.. Many insightful bods were talking about credit bubbles and historically low cross-sector volatility from about 2006 and yet little was out in the open. I was running large cross-sector comparisons and the price correlations (Rsquared) did indeed look pretty alarming; also there were large rotations in sales flows (20% of total market) away from less risky asset classes into those with much more: overall market size had also grown by at least 20% (which means that at least 1 in every 5 trades was borrowed or loaned to someone) - herding patterns looked sentiment driven; investors were reacting to media and moving irrationally into a small number of distinct directions, to find better returns, unaware of the rising levels of passive market risk they were creating by doing this. By the start of 2007 all the markets needed was a catalyst to convert that risk into loss..Cue credit crunch and the doom merchants move in; crunch gave way to recession.. before we knew it we were heading back to 1931 (or worse).. Suddenly 'Risk' was all the vogue.

At risk of becoming yet another self-prophesising hindsight peddler; I will say this.. talking about 'Risk' in the trough of a bear market (like 2008) was akin to playing Russian roulette and worrying about an unloaded gun after it had fired the bullet.. sure there was plenty of toxic debt, unemployment, thrift paradox, stagnant GDP, plenty of write-downs, falling prices, busts, economic symptoms everywhere but the 'Risk' of these events happening became virtually nil in 2008-09 because they had already happened.

No, 'Risk' should be the likelihood of when/where something might happen.. before it happens. Risk is quantifiable; uncertainty is unidentifiable. As we move into a recovery phase I again see the 'Risk' conversations disappear from the table.. just when we should be talking about it again!

Recession v Recovery? On the basis that Risk in a recession is quite different to during a recovery then I will try to relate risk in this way: think of Risk as consisting of 2 parts Active and Passive Risk - in a newtonian sense there is a constant level of risk to the investor that simply doesn't go away; it merely changes from active to passive and back again. The change is brought about by investor reactions and the flow of money. By tracking investor herding patterns and attitude to risk we can better understand where risk is/isn't for most of the time.

The first thing to appreciate is that there are ALWAYS TWO sides to the market: the Bulls and the Bears - which direction the market takes depends on who is winning the argument - by winning the argument I mean which side investors believe and move towards.. the more whom defect then the greater the chance of driving market prices in that direction.

When investors reach consensus on something and trade (BUY/SELL) in the same direction then this is called 'herding'When I mean markets I of course mean the stock exchanges; economies are less driven by immediate investment decisions; or obvious sentiment, but economies do display symptoms over a longer time period. Many believe there is about a 6-18month lag effect between the markets and economies: they drive each other but tend to always be out of sync. Much like investors and 'Risk'.

Depending on market performance, different behaviours will emerge from the Bulls and the Bears.. we can test the current point in this cycle by tracking investor buying patterns.

More to the point: I hope to highlight risk levels back to you as we make our investment decisions.

An interesting point raised by my learned friend Kon, on the Black Swan forums..

ReplyDelete"Having just read several papers by Kahneman and Tversky on investor psychology and prospect theory, all I can say is that it would take me a long time to really appreciate the depth of their research. Basically, you don't want to have the inmates running the asylum - why worry about investor sentiment? Investors are not rational, and this is exactly what Kahneman and Tversky found. So tracking investors is actually not a good way to make investment decisions. Instead, you may want to concentrate on what actually works to deliver good investment results."

I'll admit that my approach would be contrarian even among contrarians but like chaos theory there is something intruiging about managing money surrounded by irrationality. Putting aside all of the economic factors as symptoms; investor sentiment drove the credit crunch, the drawdown and the recession. That is why it is important imo.

Individually I wouldn't disagree with Kon's interpretation of Kahneman/Tversky vis a vis the role of investors and I'm still reading their work also; I would simply keep an open mind that investment markets have become social systems and thus cast up sociological problems rather than psychological pathegons.

Why? - we opened the door and allowed investors to make their own investment decisions, unbundled pension schemes, gave investment choices etc etc. The amount of money attributed to individual investors (collectives) has risen dramatically, traditional institutional investing is in decline globally.

Simply put I have suspected for some time that investors are not the happless passengers of market events that they are made out to be; they interact and create their own risk.. indeed perhaps the largest source of market risk. Individually the mind of the investor can be easily boxed up but when money flows start to shift en mass then it's worth taking notice: Tech, HY Bonds, MBS, CLO/ABS, China the list goes on.

Perhaps markets ARE an 'asylum' to use Kon's anology: People run economies not politicians.. a good example being the 'paradox of thrift'. After all an investment manager only manages the money given to him by an investor in return for a fee. If enough investors withdraw then no system can deliver investment results.

Practically, no mutual fund has sufficient cash in their box to withstand a pronlonged run AND make the expected return.

Rationality in a single investment decision is one thing but we need to face the reality that the herd is capable of being guided, cajoled, influenced 24/7 - continual push-pull forces are at play for their hearts and minds. When enough investors get together then not even the best financial minds can do anything to swim against that tide.. the only thing they can do is either swim out of its way or swim with it..

By no means am I discounting Kahnemann nor proposing that I am necessarily right; the psychologists wrong, simply that I have observed enough patterns to make me question. I will continue to track and relay anything useful back to the group.