Following Obama's announcement and the negative reaction in the markets - there are probably 3 large questions everyone is concerned about this weekend..

- Are we heading towards a 'W' shaped recovery - aka 'the double dip'?

- Has the market recovered too quickly.. are prices too high?

- Should I take my profits now (if I have any) or wait?

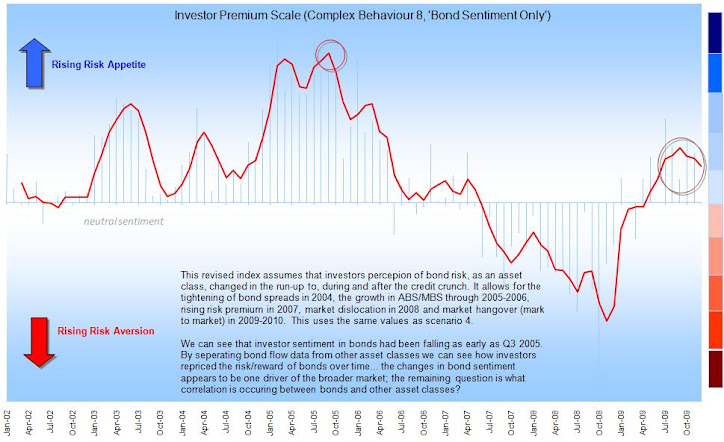

2. The 'W' shape - the reality is that describing markets via shapes is a pointless past time that has made a lot of technical folks a lot of money.. they sell you illustrations that make you feel better about what markets are doing - easy phrases that people can hook onto. They are nothing more than a narrative of what has happened and a pretty poor tool for anything else. The only thing I'm interested in is whether people believe the pundits, how many and where people may herd to next. In reality this small correction feels a bit like one back in 2004 (not to say it's the same) - people get jittery and cash their profits.. the sales flows across the mutual industry point towards this since as far back as October-November (see chart below).. the market has paused to take stock.. this is normal market behaviour folks, markets are supposed to go up AND down. Recent investor surveys also point to a lack of confidence for 2010 - investors often call this the '2nd phase' of a bull market.. it's typified by lower headline returns but strong income flow bolstered by a stronger economy and corporate profits. Economic data already looks much better for Q409 (E.g. UK - Unemployment down, purchasing up, CPI up, retail sales up, credit conditions stable..)

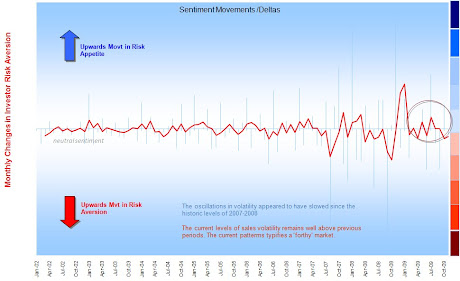

3. Lastly - are prices too high? Again there is no real marker as to whether a market has ovverun or not - yes - we have historical prices but as we know the world markets have grown by some crazy % since the 1950s so comparisons are again largely used as placebos. Any given point is either oversold or under-sold depending on your point of view. We do not know what markets will do today, let alone tomorrow or the next.. 'Experts' may like to tell you otherwise - many will show you very compelling trendings, forecasting and 'clever' math (be in no doubt there are a lot of clever people trying to work these conundrums out). I've talked about volatility swings becoming more rapid and more severe - this notion of up and down returns (useless fact for the day - clever bods call it brownian notion) is like the oscillation of a spectrum analyser http://en.wikipedia.org/wiki/Spectrometer the drawdown we saw in 2008 was unprecedented and the rate of recovery through 2009 has been (almost as) equally pronounced.

If you remember back to physics @ school then you will remember how oscillations tend to rise and fall in waves - a large down is folowed by a large up which then gradually subsides then grows again. So if that was true of investment markets then perhaps the recovery in 2009 was too pronounced - a reaction to 2008 which was a reaction to the market of 2007... 2006,, 2005.. If following that logic then we could see a zig-zag market that gradually stabilises. These are sometimes called 'frothy' markets and actually pose lots of opportunity (and risk) for active investors. The Talinn Institute of Cybernetics has lots of clever bods who look at oscillation patterns and market volatility.. the most useful thing from our point of view is that volatility is rarely symmetrical or predictable - why? because people don't behave logically. For further reading then consider Taleb's 'The Black Swan', David Stamp's 'The Market Prophets' or inded Kahnemann's study into investor behaviour.. all stimulating for the grey stuff..!I haven't sat down properly with the charts but it feels intuitively that the rate of inclimb since March has been much steeper and faster than that from March 2003-Jan 2004. This of course may mean nothing, nada, zip.. but it could also mean that the market has priced 2 years of recovery in 1.. bull runs of course don't last foreever - eventually the expectation of profit dwindles and investors cash out to protect what they have already made. This may be what we are seeing now but what is clear(ish) to me is that investors are far more sensitive to information than ever before. Of course a lot of money is still run by powerful institutions who do not react in the same way and they may be able to counter-balance some of the 'herding' patterns or encourage it to their own benefit.. Bull runs tend to last about 3 years and bears about 18 months but as we have seen there are no rules to be made or broken here.. markets are uncertain.

So if market movements were based on the 0.001% of the clever people in the world who do the trading, the lending and the investing then things should be quite easy to figure out.... Wrong!!

The fact of the matter is that every investor/worker wakes up and hopes to make money (or keep money) - there is a certain amount of money that can go around and that amount should be the total wealth of the world divided by the sum of those in it. BUT without sounding Marxist - the fact of the matter is that we are mostly engrained to want more than our lot - this is the forebear of capitalism, the American dream, and the Marx's division of wealth.

Thus to make money in markets means that someone not unlike you had to lose.. you just made 20%; well done - someone else just lost 20%.. To be blunt - the art of money-making requires winners and losers. Now in a growing economy we have a little thing called inflation that 'creates' more money by, in effect, making your money worth less.. this in turn incentivises people to make more.. If if wasn't like that then we wouldn't give companies money to grow their earnings but instead keep what we earn in cash, under the matress.. Alas then inflation is something of a neccessary evil as inflation also grows the capital of companies who can then borrow to spend, to employ, to grow earnings, to return that money back to you.. with profit. To grow earnings people need to also be encouraged to spend..too borrow, too save.. to then spend again..[supply-demand blah blah blah.. Adam Smith would be proud].

I reallly do wish that modern markets followed the conventional economic model or that I could use 17th century Japanses charts (Kagi, Renka) to predict that supply-demand as a means to buy/sell.. the problem is too much information, it's why 'EMH' (Efficient Market Hypothesis, the bedrock of finance) is such a bloody misnomer.. but also why; in a sort of mutated way, markets are so hard to beat, so hard to predict or profit from. (ok, my head hurts)..

So when you decide whether to BUY or SELL - just remember that someone has made the opposite decision; banking on you making that decision. The market also never stops - even when there is no trading - advanced computer systems are continually recalculating positions, opportunities for the next day - global timezones means someone is usually buying something; somewhere. Some markets never stop pricing and the advent of HFT (High Frequency Trading) makes this even more scary - 000000s of trades per second.. becoming faster.. algo-based systems processing information before we have processed it ourselves.. Perhaps investment markets/economies are the only true form of AI (artificial intelligence) -like the internet its network is limitless.. every peice of information (inc this blog) can have an effect but when information leads to an investment trade then its imapct is material - IT LIVES!!. Like a weather system the ripple effect is virtually impossible to predict but unlike weather the markets don't even follow laws of physics.. it's both mechanical (systems) and organic (people).. This is why some market bods are turning to organic mechanics to try and understand markets better. Good luck I say.

What's my point - not a lot I guess - simply that the wheels of the market will keep going around regardless and that our ability to predict what it will do next is pretty useless. It's chicken or the egg - do investors react to markets, markets to investors: or both..

So what do we do?

1. Stop being too focussed on the daily media (aka 'noise'). I've started allocating my assets at the weekend by which time the media has better consolidated the week's newsflow. Switch on and watch Bloomberg TV for 3 days straight for 10 hours a day during the week (I have) and you'll see what I mean..

2. Stop being too focussed on the movement of markets that often have no bearing on the returns of your portfolio.. try not to chase tails - if you had a definite plan they why change it. Set out a plan that could work in rising or falling markets.

3. Stay true to your targets - start selling/buying when you reach them. If you buy in tranches then each investment has its own timing and target - this makes investing through market changes easier. Buy when you thing something is cheaper than what you can later sell it for.

4. Be decisive - do you diversify or take risky bets? Choose and try not to overreact to markets.You won't be always right so don't try to be.. avoid compounding a mistake with another one.

No comments:

Post a Comment

Note: only a member of this blog may post a comment.