CAS: Network indices v sales flow behaviour - the missing measurable?

An interesting revelation - could mobile network indices trigger stock market changes? This question has been posed elsewhere; merits consideration.

'Do you use wireless network stat doing research? The links/queries among cellular technology, computer science and social science. Research shows that human behavior is 93% predictable:( http://www.sciencemag.org/cgi/content/abstract/327/5968/1018 ). Scientists studied anonymous cell-phone users's mobility patterns and concluded that. If cell-phone user penetration is over 95% in certain countries/areas, what is the over all predicability?

'A range of applications, from predicting the spread of human and electronic viruses to city planning and resource management in mobile communications, depend on our ability to foresee the whereabouts and mobility of individuals, raising a fundamental question: To what degree is human behavior predictable? Here we explore the limits of predictability in human dynamics by studying the mobility patterns of anonymized mobile phone users. By measuring the entropy of each individual’s trajectory, we find a 93% potential predictability in user mobility across the whole user base. Despite the significant differences in the travel patterns, we find a remarkable lack of variability in predictability, which is largely independent of the distance users cover on a regular basis.'

Wireless engineers use massive data collected by cellular network to design and optimize the network. Have we think about human behaviours when we design the network? ( we may, but not enough.)

I used to watch event impacts to network traffic patterns which seemed telling me all the stories. I tried to image what happend 30 miles or 1000 miles away. Sometimes we are anxious waiting economic data, public censue to be release in the morinings. Isn't celluar network statistic more accurate to reflect human behavior, economics and social science results?

I believe if we dig deep enough, some cellular network indices should trigger stock market changes. If one area is picked as research objective, the celluar data should be able to tell you the most recent and historic rapidly then any database.Do the current 2G/3G data foresee 4G pathes? Will you develop real time optimizazation tool to using predicable human behavior pattern? 93% is pretty high accuracy for wireless tecnology, computer sciences and especially for economic and social science.'

Entropy: I've been talking a while about working out the patterns of sales flows as a complex adaptive system ('CAS'). This would combine variances in sales patterns against variances in media flow. What I was lacking was communication.. a way to measure not only the 'noise' of media influences but the resulting 'chatter' of investor reaction; leading to finally the herding of sales flows.. perhaps amplified through High Frequency Trading ('HFT') and growth of 3G, as they take hold of the global markets.

John Marke has talked about the lack of 'slack' in the system and it might be possible to map out an end-to-end system for this. Suddenly this looks doable. JB

Quote of the day: "Great spirits have always found violent opposition from mediocrities. The latter cannot understand it when a man does not thoughtlessly submit to hereditary prejudices but honestly and courageously uses his intelligence." Albert Einstein (attributed)

What is the fuss with volatility.....

Re the movement of market returns - many believe they follow a geometric or exponential Brownian motion ('GBM') which is a continuous-time stochastic process in which the logarithm of the randomly varying quantity follows a Brownian motion, also called a Wiener process. It is used particularly in the field of option pricing because a quantity that follows a GBM may take any positive value, and only the fractional changes of the random variate are significant ('deltas').

http://en.wikipedia.org/wiki/Geometric_Brownian_motion

So in practice 'brownian motion' assumes a strong tendency to trend - it says that returns won't jump from day 1 to day 2 but move up and down in fairly predictable increments.. the returns of the previous days have an impact on the subsequent day - they are not unique. This estimation of how prices move is the underlying principal for the future pricing of derivatives contracts such as options.. i.e. E.g. to buy a contract, at one price, to buy or sell the underlying asset at a future date at a future price... this is usually referred to as the 'Black-Scholes formula' or the much much earlier Bronzin model (1908). This ties up with the old-age 'law of big numbers' (or law of averages) - where returns follow a pattern around a mean and that the volatility around that mean diminishes over time.. Where those returns are then assumed to form a normal distribution (or bell curve) then the 'GBM' is symmetrical to the mean of those returns. BUT what if we do not believe upside and downside returns will be similiar?.

A LOT of analysis has been run since to dispel this view such as many variations of the the Noble winner Robert Engle's ARCH approach in 2003 ('heteroskedasticity'.. or the analysis of different dispersions/volatilities), countless variations thereof, stochastic models (see below*), extreme loss analysis, stress testing, scenario analysis and so on - it keeps the Math boys busy shall we say...

*Stochastic models: treat the underlying security's volatility as a random process, governed by variables such as the price level of the underlying, the tendency of volatility to revert to some long-run mean value, and the variance of the volatility process itself, among others. Somtimes I use Markov chain as the easiest way to visualise and understand a random process: usually it's illustrated by the cat and the mouse:

Suppose you have a timer and a row of five adjacent boxes, with a cat in the first box and a mouse in the fifth one at time zero. The cat and the mouse both jump to a random adjacent box when the timer advances. E.g. if the cat is in the second box and the mouse in the fourth one, the probability is one fourth that the cat will be in the first box and the mouse in the fifth after the timer advances. When the timer advances again, the probability is one that the cat is in box two and the mouse in box four. The cat eats the mouse if both end up in the same box, at which time the game ends. The random variable K gives the number of time steps the mouse stays in the game..

This

Markov chain then has 5 states:

State 1: cat in the first box, mouse in the third box: (1, 3)

State 2: cat in the first box, mouse in the fifth box: (1, 5)

State 3: cat in the second box, mouse in the fourth box: (2, 4)

State 4: cat in the third box, mouse in the fifth box: (3, 5)

State 5: the cat ate the mouse and the game ended: F.

To show this for a fairly infinite number of price movements is somewhat less achievable but nonetheless that's what the clever bods have done..

Otherwise most of probability, I admit, is above my head unless it descends into some sort of practical application - BUT I get the sub-plot.. stop trying to predict future patterns from regressing past performance... show me the track record of a model (after it has been created) and I'll be one step closer to being converted.. I'll touch on stress testing, extreme analysis ('extremistan') and scenarios another day..

"The Black–Scholes model disagrees with reality in a number of ways, some significant. It is widely employed as a useful approximation, but proper application requires understanding its limitations -blindly following the model exposes the user to unexpected risk. In short, while in the Black–Scholes model one can perfectly hedge options by simply Delta hedging, in practice there are many other sources of risk." Wikpedia

http://en.wikipedia.org/wiki/Black%E2%80%93Scholes

The UK Investor - The Surprise Factor

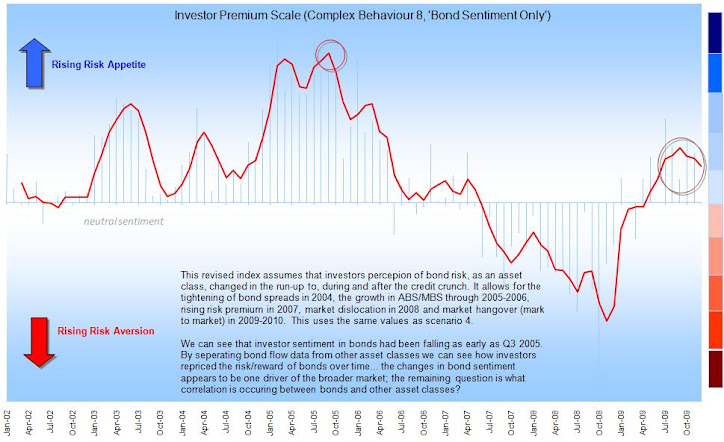

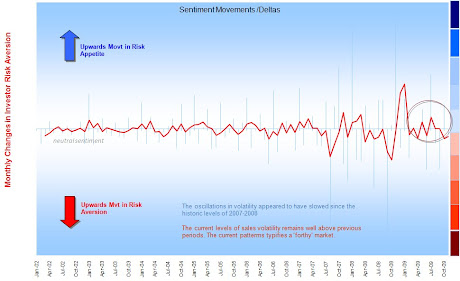

The maps in the presentation (below) really help illustrate the suprise factor of the credit crunch.. little of the previous patterns would prepare the UK investor for what was about to come. The flows show that investors did not recognise the risks inherent in 2006-2008. This is because the industry uses conventional fund metrics, which were at best outputs not guides..!

No comments:

Post a Comment

Note: only a member of this blog may post a comment.